Beginner’s Guide To Texas Rural Property Taxes

According to the American Farmland Trust, 84-percent of the state of Texas consists of rural land, which means rural property taxes. It can be difficult to understand how the amount you owe is determined. Let’s look at everything you need to know about rural property taxes to clarify any confusing points.

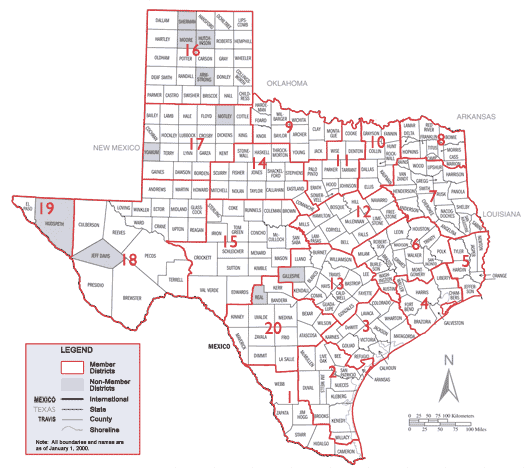

COUNTY APPRAISAL DISTRICT (CAD)

It is important to contact your County Appraisal District to determine the amount of taxes to

be paid. The CAD will specify

which types of local government

are taxing your property. They include:

- City

- County

- Water district

- MUD district

- Hospital district

- School district

The CAD sets the value of your property each year, and is responsible for sending you a

yearly bill.

A QUICK EXPLANATION OF DISTRICTS

Let’s examine each of the taxing districts a little further to see what your taxes go towards.

- Water Districts – The water district collects property taxes for water-related development and improvements. This includes flood control, irrigation, and levee improvements.

- Hospital Districts – It’s important to know that not all hospital districts levy property taxes. In fact, hospital districts can only levy property taxes if the district receives voter approval to do so. This money may be used to support hospital operations, provide indigent care, and more.

- Municipal Utility District (MUD) – This is a subdivision of the state that is designated by the Texas Commission of Environmental Quality to provide sewage, water, drainage, and other services within the MUD boundaries. MUD rates tend to decline over time as it operates like a debt service whose costs are shared by homeowners association (hoa company in greenville sc).

The remaining taxing districts, city, county, and schools, are common across the state and most rural properties should expect to pay a tax to each. These taxes go towards the improvement of roads and schools as well as the funding of the fire and police departments..

AGRICULTURAL VALUATION AND ROLLBACK TAXES

Agricultural Valuation applies to land that is almost solely

designated for agricultural uses including livestock, crops, poultry, and fish. It may also include land that is left idle for government programs, or for livestock or crop rotation. In addition, it may include land used for raising specific exotic animals needed to produce items for commercial use or to be consumed as human food.

This land must have been used almost entirely for agricultural production for a minimum of five of the past seven years. However, if your land is located within the corporate limits of a town or city, it is usually not eligible for agricultural valuation.

If your land meets the criteria for agricultural appraisal and you opt to change it to use for something non-agricultural, you will owe a rollback tax for each of the five years during which your land received the lower appraisal. This is the difference between the taxes you paid on your land’s agricultural value and the amount of taxes you would have owed if the land had been taxed at its higher market value.

WHY RURAL TAXES?

Texas is one of only seven states that doesn’t require residents to pay income taxes. As a useful service, property taxes are used to fund local services and improvements, such as maintaining roads and public schools, paying the salaries of public employees, and more. The state government does not benefit from any local property taxes collected.

Texas is a great state in which to own property, as you can see. If you have further questions, you can always contact your County Appraisal District.