Understanding Mineral Rights In Texas

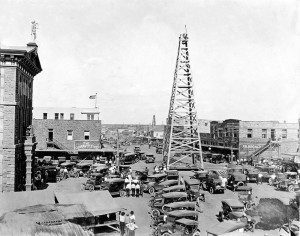

In most countries around the world, minerals found in earth belong to the government. The United States is an exception, and here in Texas we have a long history of mineral rights that dates to 1869.

Rich with natural resources, Texas is home to many types of minerals, some of which might be in your land. Oil and gas are the most common found in Texas.

About two-thirds of the state actively produces oil, and it has made this state economically successful. In 2013, Texas oil wells produced about 34.5% of the oil output in the US, an incredible explosion in growth from 15% just a few years ago.

Natural gas production in Texas is also significant. A staggering 27% of all natural gas in the US comes from here, which would make Texas the third largest producer in the world if Texas was its own nation.

Many Texans are cashing in on this opportunity to make significant income through the natural resources found on their land, so why not you? Here we will look at the basic steps from understanding your mineral rights to receiving your first royalty check.

YOUR RIGHTS

As long as a previous landowner has not severed the mineral estate from the surface, the owner retains full rights to whatever minerals are on his/her land. You can check with your local county clerk’s office for free to make sure a previous owner did not sever those rights.

Then, an attorney will help you with a “mineral title opinion,” the legally binding document to substantiate mineral ownership in order to make money.

Often, landowners don’t even know they have minerals on their properties until an oil or gas company contacts them. If you have not been contacted and suspect you have valuable minerals on your property, research current local wells and find out who the best operating companies are. There are many oil and gas drilling companies in Texas, and you can find some of the top rated ones on this website.

WORKING WITH THE OIL OR GAS COMPANY

To produce income, a property owner signs a legal agreement to lease the mineral rights. This contract is called an “Oil, Gas and Mineral Lease.” A basic lease will consist of an up-front lease bonus payment and royalty percentage, in exchange for the oil company drilling.

Typically, the operating company assumes all expenses to develop the land. The company will likely propose a drill site on your property, and notify you of the location. They should pay for any damages that may happen related to surface use, roads, pipelines, etc.

Installing operating equipment such as wells can take anywhere from 10 to 90 days. Drilling operations will take a similar amount of time.

OIL AND GAS MEASUREMENT AND ROYALTIES

By law, the oil and/or gas are measured at the well site using a gas meter or the levels in a storage tank. Your royalty payment is calculated through the gross volume that was measured.

On average, the company keeps seven-eighths of the interest and the landowner earns one-eighth, but that number is often negotiable. Sometimes fees are taken out of a royalty check to cover compression and/or the removal of impurities, which are necessary to make the production ready for sale. Make sure you ask about these deductions beforehand, as they are often taken to court.

LEARN MORE

For more information on your mineral rights as a landowner, visit MineralWise, “Insight For Royalty Owners.”

For a list of the the major oil and gas fields, and highest producing counties in Texas, click here.

If you’re shopping for some beautiful Texas real estate, browse some properties with known minerals. Then, contact us online or give us a call at 830-569-3500.